Signs of Recovery

Despite the media frenzy over high unemployment and other worrisome economic headlines, there are signs the global markets are stabilizing, and that risk taking is increasing. I have a shit ton of charts to prove this point, way too many for the average Joe, so I’ve narrowed it down to 5 for this post. If you find yourself confused and you cannot make heads or tails of the X’s and O’s, please bear with me as I am still working on a user guide to my charting method. Without further ado, let’s get to the numbers.

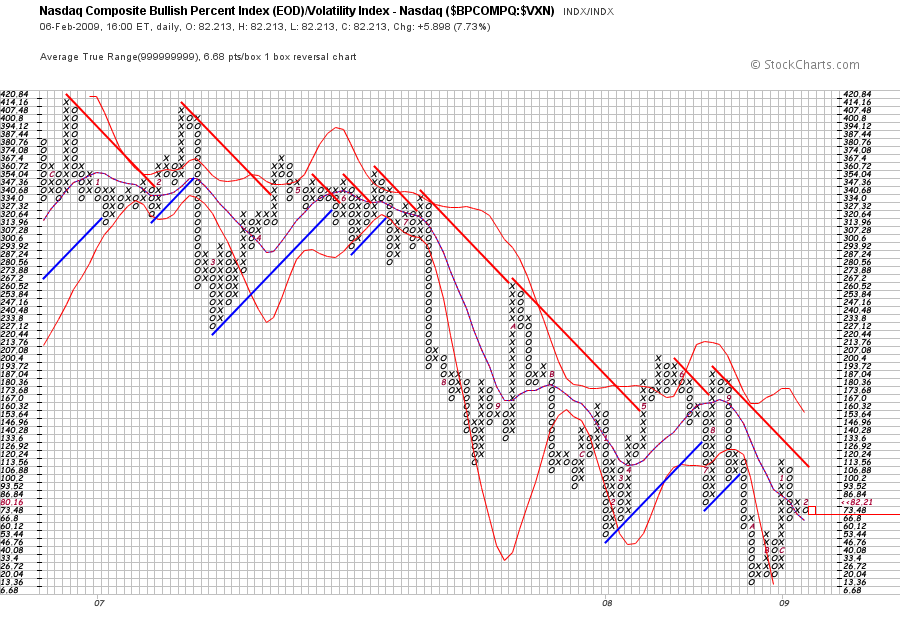

Unlike its sibling chart BPSPX:VIX, the NASDAQ “Bullidex” (Copyright Trademark Patent Pending) is beginning to show signs of strength, though the new “2” on the far right representing February obfuscates the fresh X. This signifies an increasing number of NASDAQ stocks in bullish formations amidst declining volatility, though the indicator remains in dangerously bearish territory. So long as this trend continues, the market will favor bets on the long side, but since daily swings remain violent, I’m still using cautious position sizes.

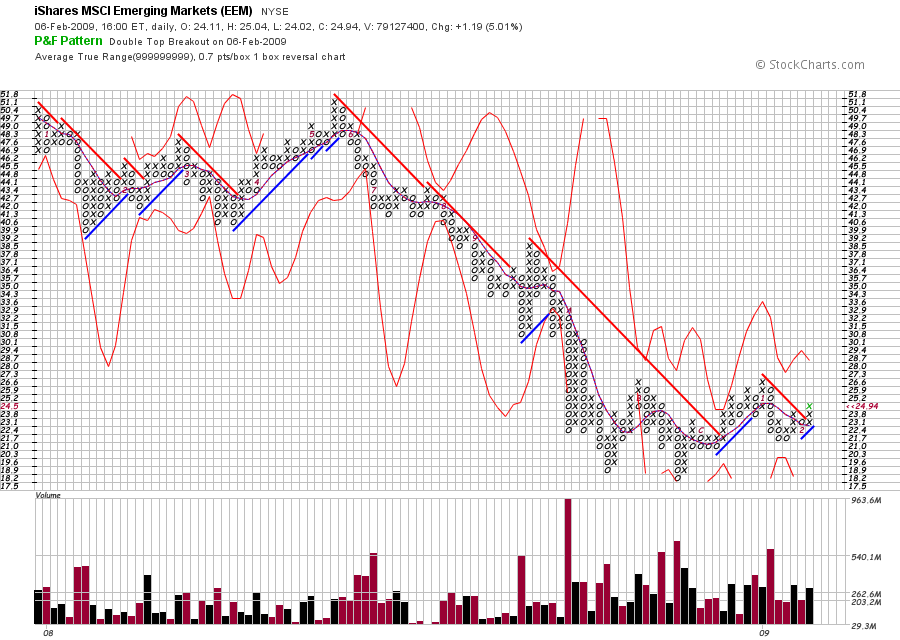

Emerging markets have entered a new uptrend, which bodes well for the market in general. Since this asset class is considered high risk, it is good to see interest in this sector.

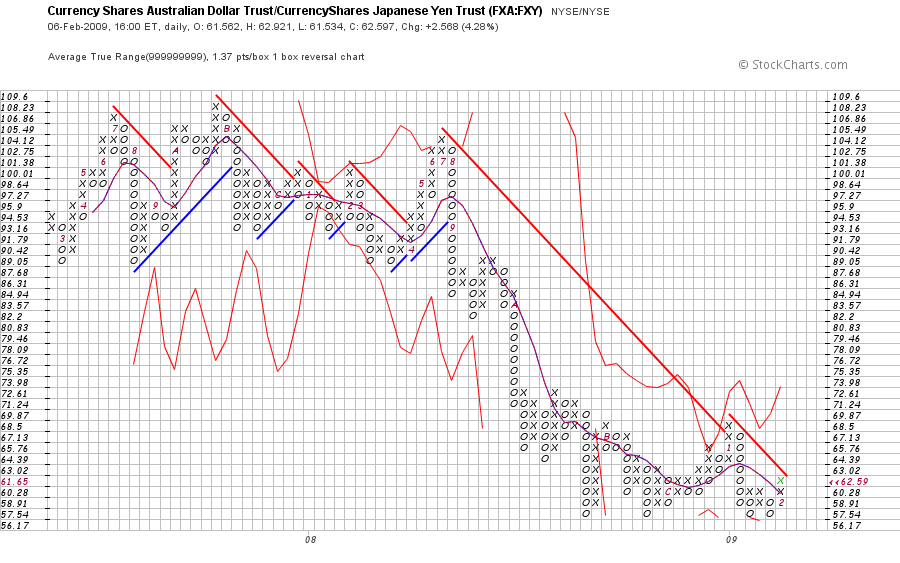

The Yen carry trade may be resuming as people sell low yield Yen to acquire the badly beaten AUD. This is an excellent sign of reflation, so keep an eye on this.

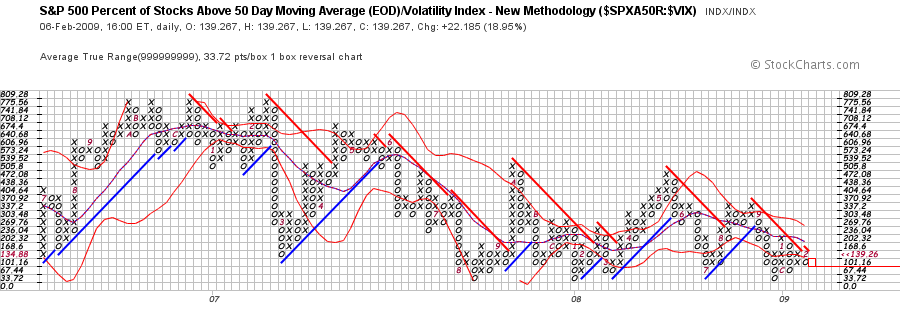

SPX stocks trading above the 50 DMA are increasing with relatively lower volatility. This is the first sign of a bullish trend in the SPX, but stay cautious as there are other red flags in the sector.

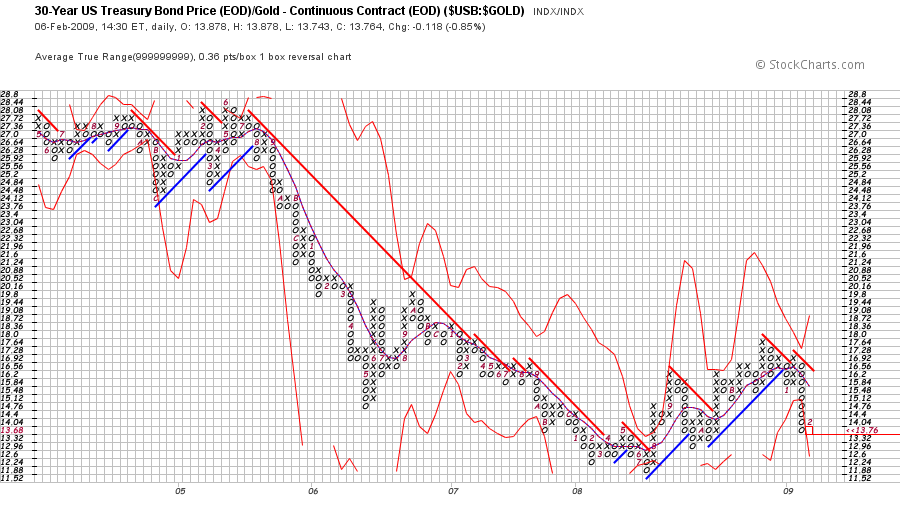

Treasuries have had a remarkably steep sell off relative to gold, and this suggests an end to the credit crisis that plagued investments in 2008. Look for further weakness in the Treasury market as people move from “risk free” yield to assets with greater potential for price appreciation in the changing environment.

The specter of deflation is being replaced by an inflationary trade. Precious metals seem to be fairing the best, and gold miners are not far behind. Stay flexible, and don’t pay attention to the headlines that espouse the impending doom of the U.S. financial system.