The Top Ticker on Twitter

Here is the Bloomberg scoop on Apple (AAPL), today’s top ticker on StockTwits.

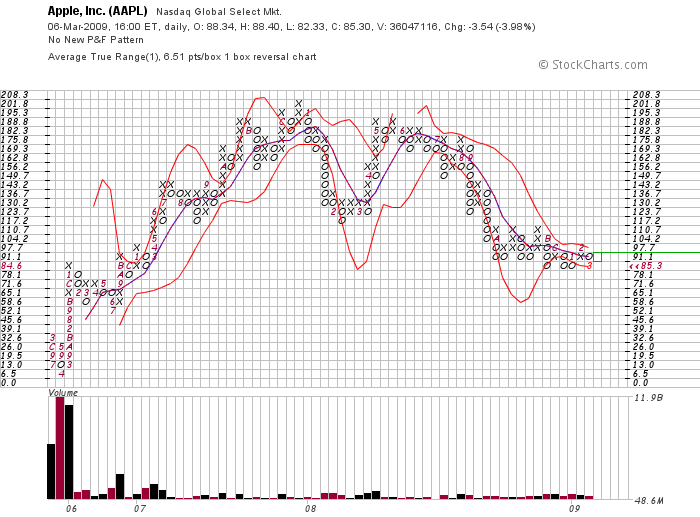

AAPL is retesting support for a third time, trapped by resistance around 98.

According to Bloomberg, a JP Morgan analyst named “Moskowitz, who has an “overweight” rating on Apple’s shares, cut his price target to $100 from $102… [because the] next few quarters stand to get bumpy.”

$102 to $100… for real? Mr. Moskowitz gets paid to adjust his questionable forecast by 2%?!? Meanwhile, AAPL continues to go down, and looks ready to suck pipe with a potential reprieve in the 50’s.

Moskowitz points out, “[t]he company could partially offset the weakening demand environment for desktop PCs with potential buzz around new features and price points,” but that misses the point. Luxury companies like AAPL are utilizing brand dilution for growth, and any “buzz” surrounding features and price will do NOTHING for investors.

AAPL was a stock held by every manager before the credit crisis started whooping ass. Now that funds are desperate to raise capital, massive inventory liquidations are underway, and AAPL remains on the shit list.

Needless to say, I’m pleased that my best friend’s mother sold her shares at my behest in July of 2008. If you’re an AAPL fan, do yourself a favor and trade something with less emotional sentiment.