The S&P 500 Trend

To be wealthy in life, you gotta recognize iced dice. Today’s odds are dangerous, don’t catch a falling knife.

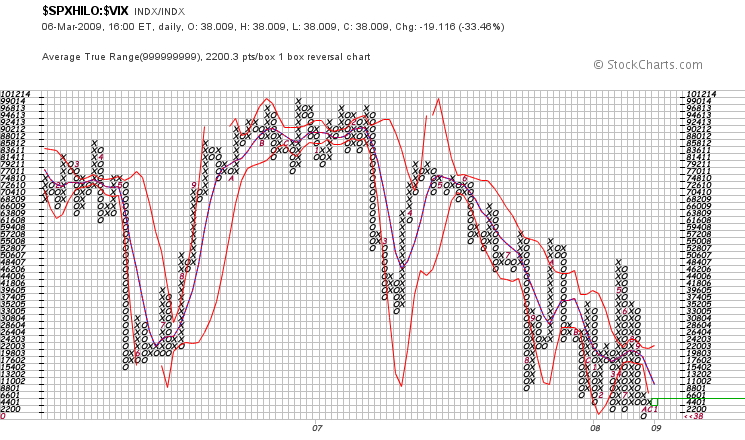

This is a composite of two derivatives, the Record High Percent (SPXHILO) and Volatility (VIX) Indexes. Together, they describe a market probability, the percentage of stocks at new highs/volatility (SPXHILO:VIX).

This is a composite of two derivatives, the Record High Percent (SPXHILO) and Volatility (VIX) Indexes. Together, they describe a market probability, the percentage of stocks at new highs/volatility (SPXHILO:VIX).

Making money is easier when stocks are at new highs, but the risk is greater if the volatility’s in the sky. As stocks make new highs and volatility drops, the SPXHILO:VIX will rise, which is a good thing for stocks. If volatility increases and stocks breakdown, the index will fall, and so will your account.

Unlike line or candlestick charts, the direction of this graph is shown via X and O marks. On the left it begins in 2006, and the subsequent months are denoted in alphanumerics (1-9 and A-C are Jan-Sept and Oct-Dec respectively). A look at the x-axis reveals 2007 begins near center, and 2008 and 2009 are close in the right corner.

The irregular spacing is from the Point and Figure (PnF) method, which reduces noise by ignoring times passage. Non-linear time is the effect it creates, only making marks if values fluctuate. Months can pass without a visible change if the relationship between SPXHILO and VIX stays the same.

Since October of 2008, this indicator has shown little change, it’s as low as it goes and indicates a rigged game. Rigged against players who think they have a chance, of catching a fast knife without cutting their hands.

When stocks are falling and volatility is high, I leave investing to the super rich guys. For me this market is about quick profits and trades, long term buying is an invitation from Hades.

but the risk is greater if the volatility’s in the sky

Not true at all. One of the biggest misperceptions in the market is that higher volatility means higher risk.

Volatility is one measure of risk, and is by no means the only valid one. Position size will mollify the risks of a trade, but volatility is a good gauge of uncertainty. High volatility implies a large gap in participant perception, which may be advantageous for short term traders, but it is troublesome for novice investors.

In reply to your direct message on twitter, the applet does not allow me to send direct message to those who are not following me. (Sort of Church Lady prudish isnt that special. LOL.) This site does not have your email link, so this comment area serves as a fallback. Not even sure if you remember your question at this point, if so, send me a headsup in email and I will reply as per direct message nix-twitter-confabulation.

Also tried to send reply via Adobe TweetDeck, but the applet is a pass through agent for Twitter and message did not go direct to you, as per code of twitter. See general theme above, church lady operating as potential contributor @ twitter. Takeaway Warning: Church Lady may be coding @ Twitter.

My Twitter question still stands, what made you follow me? And more importantly, who is this Church Lady you speak of?

Saw you posted link to Geithner parody on SNL. [[Daily Options Report: Tim-Ber “Geithner takes calls on the best way to spend bailout money.” Written by chucklesamadeus, March 9, 2009 at 9:29 am]] http://smokingsecurities.wordpress.com/2009/03/09/daily-options-report-tim-ber/

So you dont know your SNL alumni, np. The Church Lady is a character developed for skits on SNL. Google SNL alumni and comedian Dana Carvey.

As for the other, I noticed the recommendation by Howard Lindzon; near Mar. 09 at 12:01 AM. Thereafter observed the charts you were posting. It was the charts.

Howdy. I would like to add your excellent articles to my site via your RSS. http://www.tradinghelpdesk.com

Please let me know if I can.

mike at tradinghelpdesk.com

Thanks for reading and feel free to add me.