S&P 500 Analysis

The S&P 500 took a beating today, and there is no sign of an end to the selling.

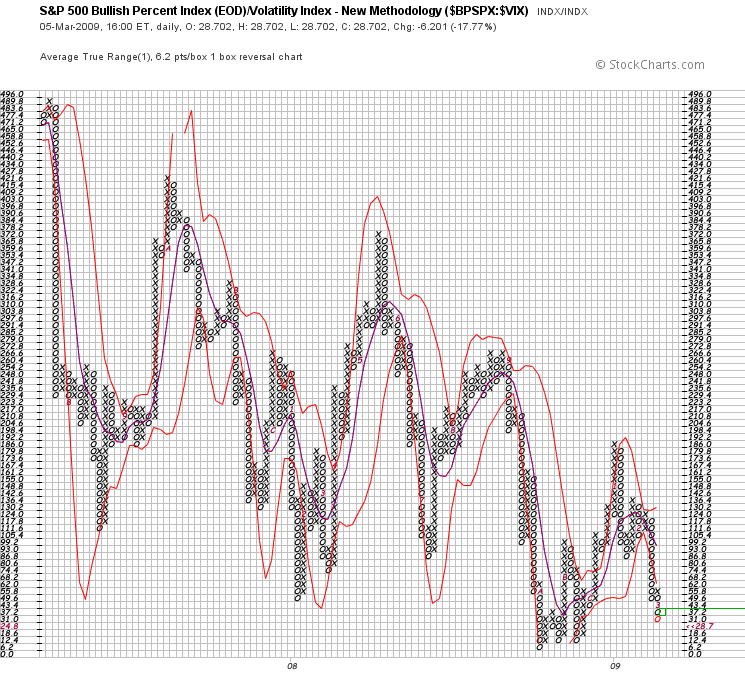

Volatility continues to increase amidst a declining number of rising stocks.

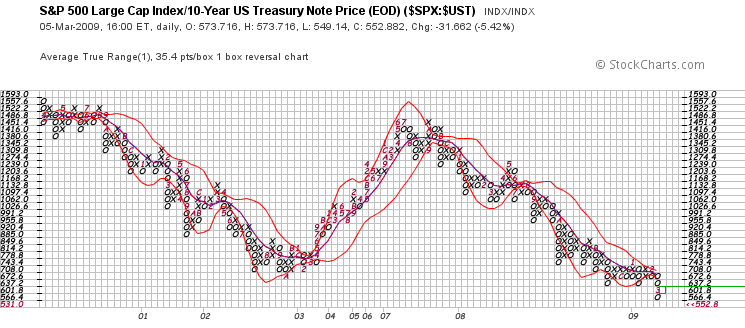

Priced in 10Y T-Bills, the SPX is making a waterfall with no noticeable support to stop it.

There is no reason to call a bottom in the S&P 500, and despite the oversold condition, we have yet to revisit the intensity of October/November. With JPM, WFC, C and BCS headed for the can, who knows how much inventory will be sold to to raise capital in these final hours? Cash is king, and there is no reason to be a hero.

Let the dust settle before kicking into buy mode. This is a massive bear market and significant downside risk remains.