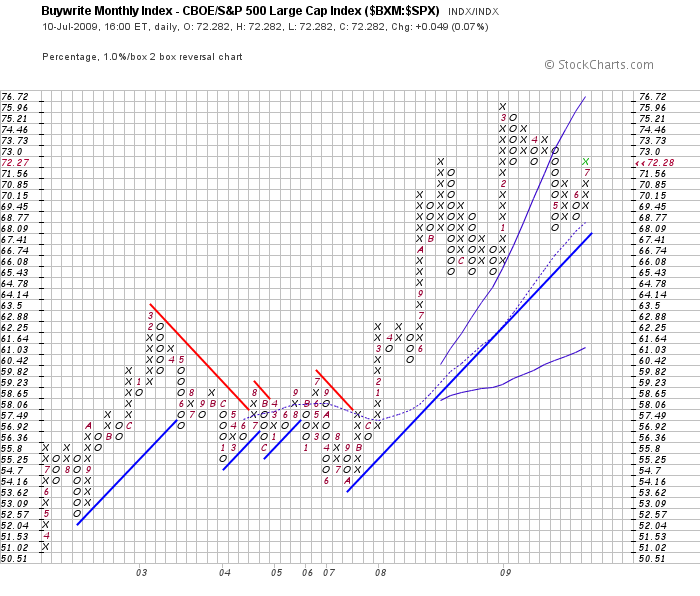

Buywrite vs Index ($BXM : $SPX)

BXM:SPX compares the relative performance of selling S&P 500 covered calls against holding the equity unhedged. When buywriting outperforms the underlying index, it implies that the market is weak because option writers are keeping premiums as strikes remain out of the money.

BXM:SPX compares the relative performance of selling S&P 500 covered calls against holding the equity unhedged. When buywriting outperforms the underlying index, it implies that the market is weak because option writers are keeping premiums as strikes remain out of the money.

Since the credit crisis began in late 2007, the relative strength of BXM vs SPX cannot be denied, as it continues to trade in an uptrend above a rising 20sma. The pattern being formed is similar to late June 2008, as well as December 2007 and 2008. With plenty of bearish signals out there, stay vigilant and live to trade another day.