Bounce in the Works?

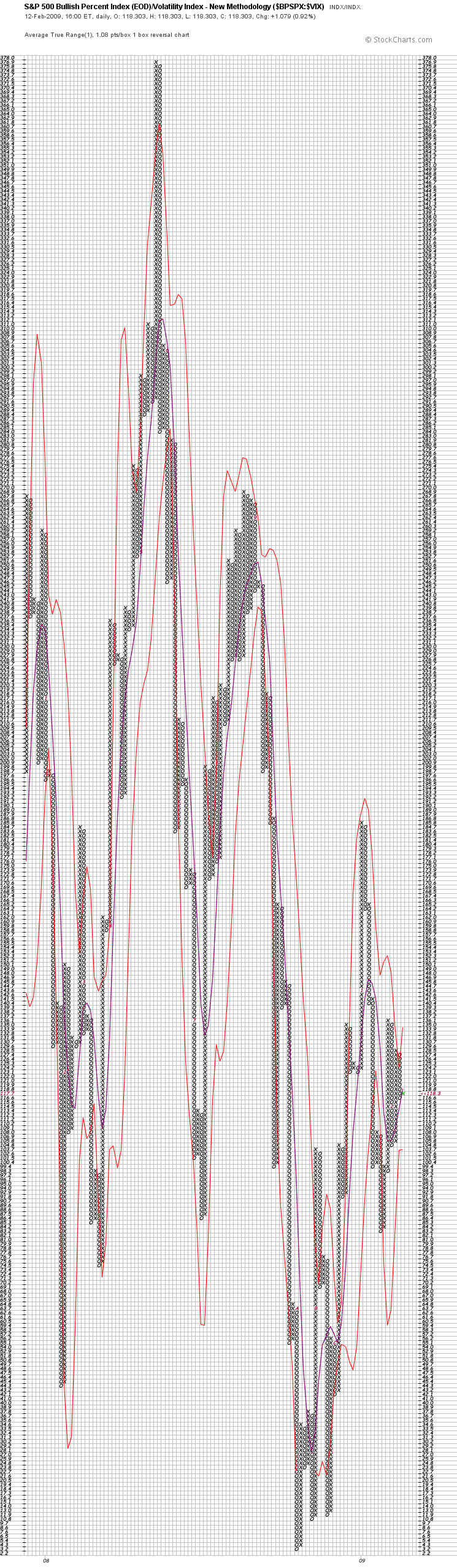

I should have posted this last night, but I got wasted on the LES and awe struck by some massive titties. What’s worse, this is by far the most difficult chart to read because of its massive height. The scaling of the Y-axis is dynamic due to the ever changing Average True Range of the Bullidex, and it sometimes makes charts that are less than pleasing on the eye.

The most important thing to take away from this complex visual behemoth is the tiny new green X being printed on the far right. That signals lower volatility and an increasing amount of rising stocks. Granted, one X is hardly a strong trend, but I take this as a sign of general market indecision.

Bears are too scared of government rhetoric, and the bulls have no fundamental thesis to give them conviction. Sellers need to remain patient as buyers begin to realize that the socialization of the American financial system will not save the equity markets. Investors are being duped by outrageous taxable dividend yields in exchange for capital losses and further asset cannibalization, talk about sustainable business models!!!

Good luck to all who try to swim in a direction amidst such treacherous waters. I’m mostly in cash, selling small hedged positions in leveraged ETF pairs to capture the volatility trade. If you must buy something, EEM and gold related ETFs seem like the most likely place for upside, but manage risk by keeping positions small due to the enormous chop.