S&P 500 Bullidex ($SPY)

What is Bullidex?

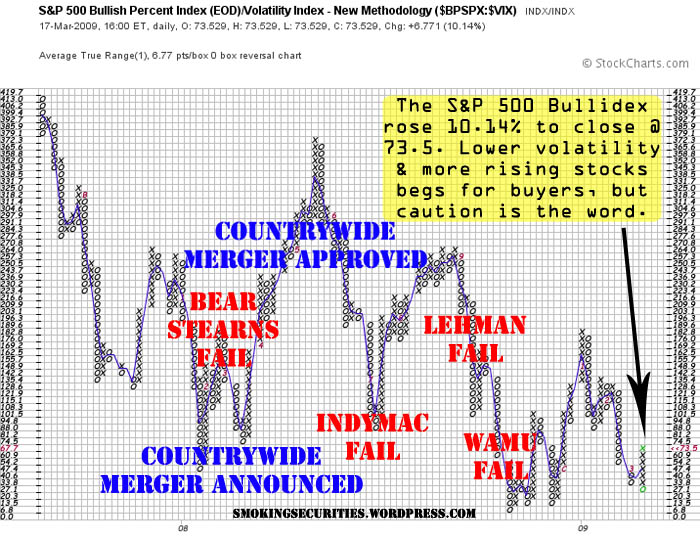

Bullidex is short for ‘Bullish Percent Volatility Index,’ a combination of S&P 500 derivative indexes to measure Reward & Risk.

‘Bullish Percent Volatility Index’?

Think of it as a Reward & Risk Index.

$BPSPX tracks the percentage of rising, or “bullish,” S&P 500 stocks. The Reward.

$VIX is the S&P 500 Volatility Index, a.k.a., “The Investor Fear Gauge.” The Risk.

Together they form $BPSPX:$VIX, or Bullidex, a market description that prescribes adaptation.

I’m still confused…

Investors that seek profitable and stable returns should invest in markets with more rising stocks and falling volatility.

Purchasing winners is easier when there are more to choose from, so an increasing number of advancing stocks is valuable.

Selling for a loss is unlikely if the price fluctuates within your expectations, thus decreasing volatility is advantageous.

S&P 500 Bullidex

Okay, but how do I read the damn thing?

X’s signify an uptrend, O’s mark a downtrend. The blue line also indicates trend direction. Buy up trends and sell downtrends.

So what do I buy?

In this case, since this is the S&P 500 Bullidex, you would buy the ETF ‘SPY’.

When do I sell?

Sell as the trend changes. When fewer stocks rise and volatility increases, O’s will start to form and the blue line will head towards zero, lowering the recommended trade size.

Is it that simple?

Yep, though the Bullidex also suggests position size by dividing the current number (73.5) by the chart high (419.7) for a capital allocation percentage (17.5).

Errr… wha?

Never mind, just don’t lose money, keep doing your homework and continue reading this blog.

Love the last line….

Hey Chuck,

Nice buy signal @ 47.40 looks close to resistance now.

Hey Scott,

I picked up a buy signal here on March 10th @ 38.3, though from the looks of this chart, 47.40 is the entry.

On another note, I’m not sure if the rules of support and resistance hold for the Bullidex because neither derivative is traded (VIX has some vehicles, but BPSPX does not). Nevertheless, you’re point is well taken.

Thanks for reading and feel free to share your thoughts on this stuff. I need all the feedback I can get.