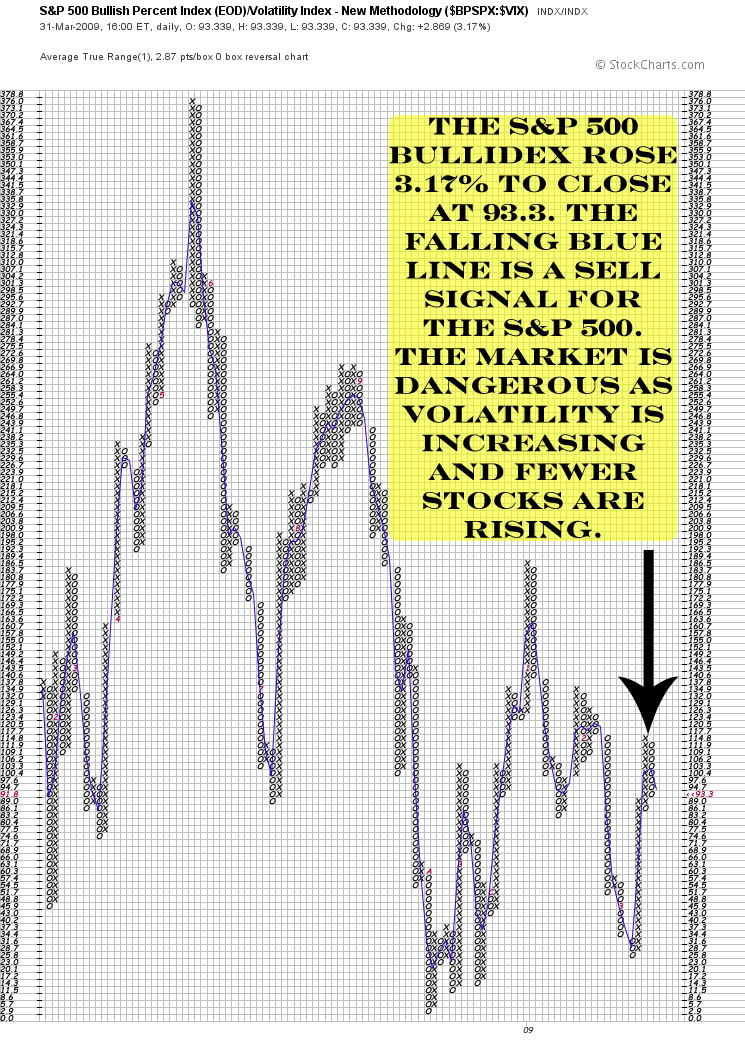

S&P 500 Bullidex ($SPY)

The rally that began 21 days ago on March 10th seems to have come to an end, so my intraday bias is to the short side. Investors must beware the recent change, volatility is rising and more stocks are falling. The 2x S& 500 Inverse ‘SDS’ looks like a good buy, but I’m more interested in shorting ‘SSO’, and hedging it with a short position ins ‘SDS’. Why buy these worthless swaps when you can sell them for the same effect?

The rally that began 21 days ago on March 10th seems to have come to an end, so my intraday bias is to the short side. Investors must beware the recent change, volatility is rising and more stocks are falling. The 2x S& 500 Inverse ‘SDS’ looks like a good buy, but I’m more interested in shorting ‘SSO’, and hedging it with a short position ins ‘SDS’. Why buy these worthless swaps when you can sell them for the same effect?