In Cash I Trust

Despite the buoyancy of some financial stocks, the market remains in liquidation mode with fewer stocks in bullish formations and increasing volatility. Cash remains king, whether it be greenback or gold.

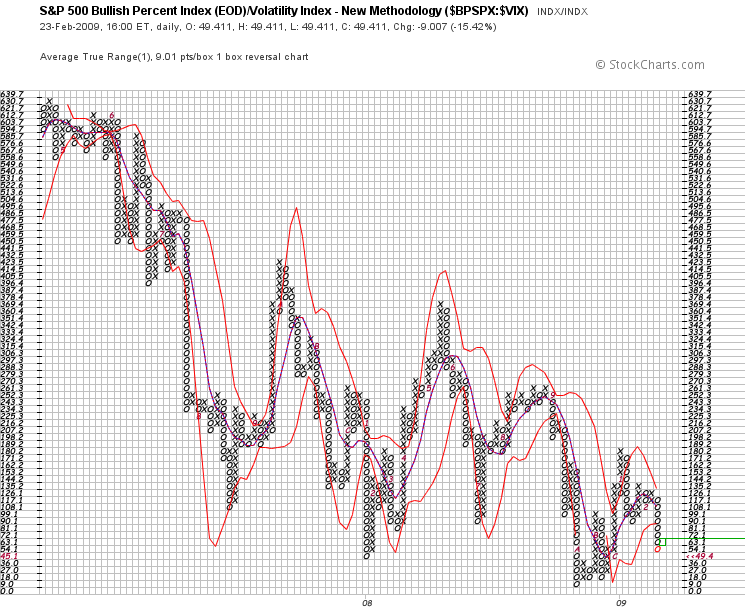

Until the above chart begins to show a new row of X’s on the far right, there is no need reason to get long this market, unless you are a disciplined day trader focused on a small time frame.

There is little statistical advantage to bottom picking in anticipation of a reversal, so I will let the market be my guide, and stay on the sidelines until the volatility begins to fall and more stocks begin to rise.

Charles,

Thanks for sharing.

I agree that there is little reason to go long here, but it sounds like you’re staying mostly cash and not going short via ETFs? I’m thinking that once we break S&P 741 we free fall down and it’s rocket time in SRS, FAZ and the like – thoughts to the contrary?

I trade the short ETFs during the day, but I’m not inclined to hold them overnight. SRS and FAZ will collapse if there is a ban on short selling, and since the Federal government has shown a willingness to do this in the past, I’m too scared to commit any real money to that trade overnight.