New High Short Squeeze and PnF Theory ($GMCR)

On April 22nd, I posted this piece on two stocks with excellent traits for investment. Clearly my head was on straight as GMCR surged 40% on Thursday.

On April 22nd, I posted this piece on two stocks with excellent traits for investment. Clearly my head was on straight as GMCR surged 40% on Thursday.

While luck is a factor and such performance is highly unusual, it reinforces my belief that stocks trading at all time highs with large short positions are great investment vehicles for intelligent risk managers.

There was no need for me to research the fundamentals, analyze the business model, follow earnings or watch for new partnerships. The price trend tells me that the smartest players are buying.

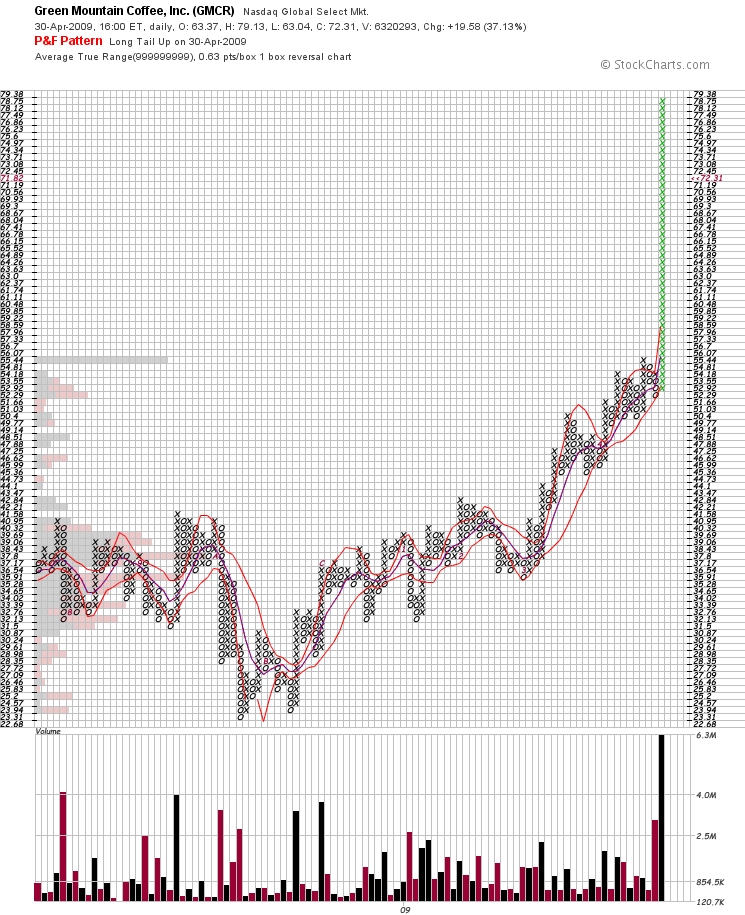

A fellow on Twitter mentioned that my charts are difficult to appreciate for the uninitiated, so I’ll run through some basic Point and Figure (PnF) theory to clarify my method.

PnF charts have a few distinct differences from standard line/bar/candle/OHLC charts, most notably the non-linear expression of time. Unlike other methods, a new mark (X or O) is only created if price changes.

Each new column on a PnF chart represents an uninterrupted price trend, that is, a line of X’s signifies a rise in price, and O’s a decline. Thus, the value of the PnF method is the reduction of trading noise and the ease of recognizing price trends.

The function of time is expressed in two parts, years on the bottom, and months denoted via alphanumerics embedded in the price. 1-9 indicates January-September, and A-C are October-December.

Another wonderful feature of this style is the price by volume, indicated by the horizontal bars on the left. As illustrated by the chart above, buying in the 55.44 range prompted the short squeeze that catapulted GMCR to great heights. Price by volume can give some indication of support and resistance, and it often forms bell curve distributions.

Finally, one more feature of PnF is the ability to scale the y-axis to the Average True Range (ATR) of the security. While I won’t go into the details of ATR, I recommend research on the subject, especially from trading coach Van K. Tharp who has some excellent material on the subject. ATR price scaling creates unique price distributions, tailored to the action of the security.

If there are other questions or comments, please leave a note, and I’ll do my best to clarify my ideas.

hey congrats and great call! I’ve been long GMCR myself as well since late March for some of the same reasons you’ve mentioned. So interesting to me how we can be looking at two different styles of charts (candle vs pnf) and come to the same conclusion. The 40-50% short float was a glaring factor to me, and once it cleared resistance around $45 and started making new 52 week highs it was a no-brainer.

I’m not as familiar with PnF as I would like and I stick to the usual technical analysis, but I’m definitely interested in learning more and look forward to reading more about it.

congrats again, “victory” is ours.

Jay

@marketfolly

nice post! GMCR was a smart play indeed! And you’re right * about the PnF chart.