S&P 500 Bullidex ($ES_F $SPY $SPX)

The number of stocks trading above the 50dma is rising relative to volatility, which is more evidence of a strengthening uptrend. The odds for successful investment are increasing because the probability of purchasing a strong stock with less risk is growing.

The number of stocks trading above the 50dma is rising relative to volatility, which is more evidence of a strengthening uptrend. The odds for successful investment are increasing because the probability of purchasing a strong stock with less risk is growing.

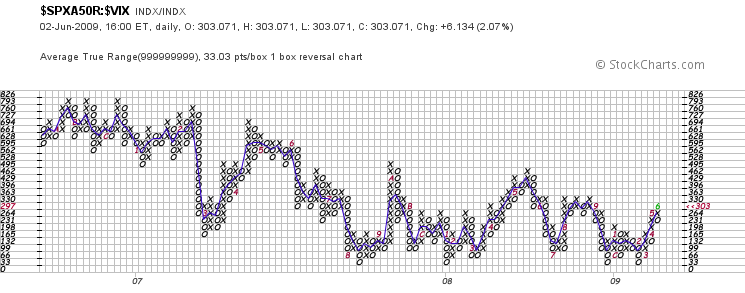

According to this chart, the S&P 500 stands at pre-Lehman failure levels, the green 6 (June) in 09 is on the same level as the red 9 (September) in 08. The SPY trading at 95 still remains below its September 2008 price of 125, so there is ample room to run.

Bears are getting cooked in this heat, so expect further deliciousness despite the economic tragedies emanating from your infobox.