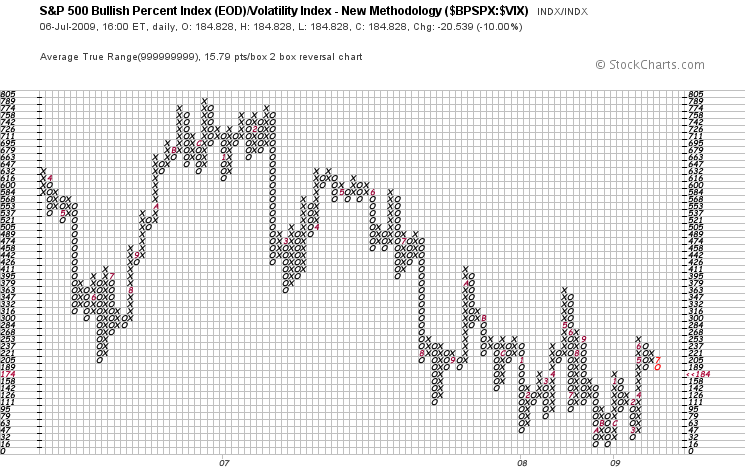

S&P 500 Bullidex ($ES_F $SPY $SPX)

Despite today’s reversal and positive close in the S&P 500, the Bullidex fell 10% to close at 184. This divergence suggests a weakening uptrend and signals downside risk as volatility increases relative to the number of rising stocks.

Despite today’s reversal and positive close in the S&P 500, the Bullidex fell 10% to close at 184. This divergence suggests a weakening uptrend and signals downside risk as volatility increases relative to the number of rising stocks.

The month of June was a whipsaw cluster-fuck for my indicator, but that comes with the territory. Though I did have the foresight to keep my positions small, I gave up a noticeable chunk in trading costs as many breakouts made reversals and the markets oscillated.

I’m trying to brush up on options theory as much as possible, for I’m interested in selling vertical call spreads one month out on FAS and FAZ once they reverse split. Capturing theta decay while shorting with limited risk and hedged delta seems like a good way to play a range bound or bearish market. I’m neutral with an increasingly negative bias, but I’m not running to the exit till I see some confirmation.