S&P 500 Bullidex ($ES_F $SPY $SPX)

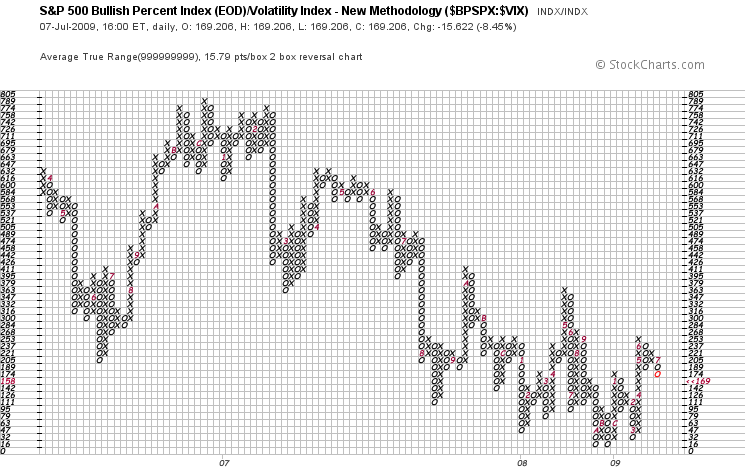

Things look grim for the S&P 500 as the Bullidex fell 8.45% to close at 169, breaking the June low. This is a big warning sign to all equity investors as the volatility increases relative to the number of rising stocks, which lowers the probability of successful investment.

Things look grim for the S&P 500 as the Bullidex fell 8.45% to close at 169, breaking the June low. This is a big warning sign to all equity investors as the volatility increases relative to the number of rising stocks, which lowers the probability of successful investment.

Bull markets tend to see a reduction in volatility with a greater number of stocks at new highs, like the rally from mid March to early June. On the other hand, bear markets are emotional, panic driven and erratic, causing investors to seek liquidity by driving down prices.

Don’t fight the trend, just go with the flow and accept the direction of the herd, otherwise you will get trampled. How long this pullback lasts cannot be determined, so it is best to adapt to the current conditions and live to trade another day.