Twitter Ticker ($INTC)

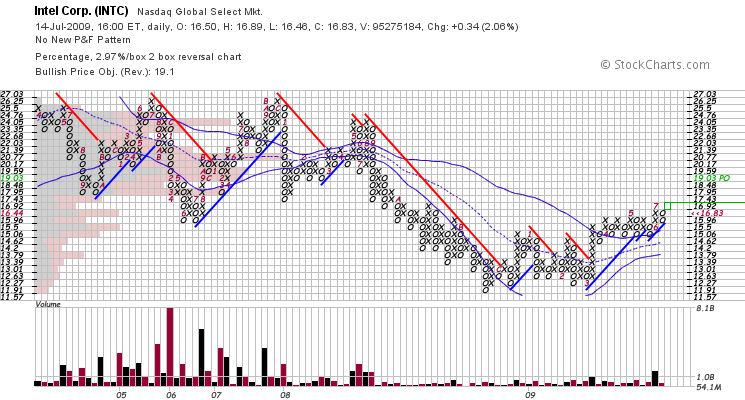

Intel is buzzing on StockTwits after posting better than expected earnings and rising 7% after hours. I’ve been accumulating INTC since posting this in April, and I’m hardly surprised by the stellar results. The semiconductor sector has been leading, and the numbers prove the market was ahead of the curve.

Intel is buzzing on StockTwits after posting better than expected earnings and rising 7% after hours. I’ve been accumulating INTC since posting this in April, and I’m hardly surprised by the stellar results. The semiconductor sector has been leading, and the numbers prove the market was ahead of the curve.

Trading above the upper Bollinger in an uptrend with a rising 20sma is a technically strong position, indicating market confidence and increasing expectations. Rather than sell some, I may add more to my position, especially if the strength of the last two days persists. A move below 15.5 would suggest real weakness.

From my experience as a computer repair service operator, Intel’s ubiquity thrives as the brand continues to command a premium amongst retail consumers. Emerging markets are eager to grab technological wealth, and the need for mobile information processors will only grow as we become increasingly netcentric.

Make no mistake, INTC is an old and boring blue chip that will not show the stellar growth of newer companies. Nevertheless, it is moving up in a predictable fashion, and there is no reason to argue with the price action.