Familiar Territory

Everything has changed, but nothing seems different.

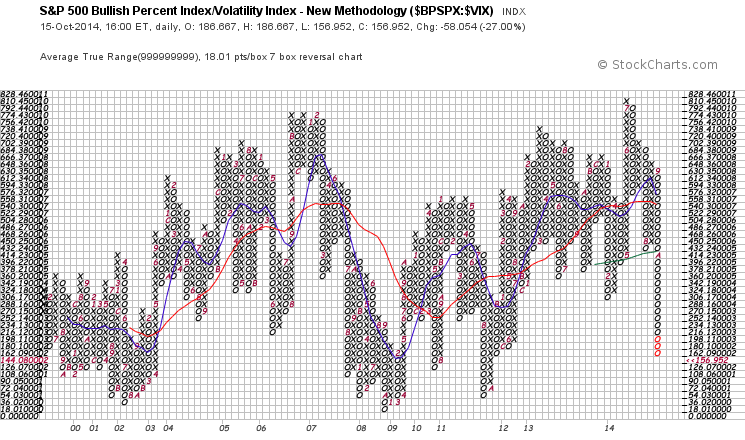

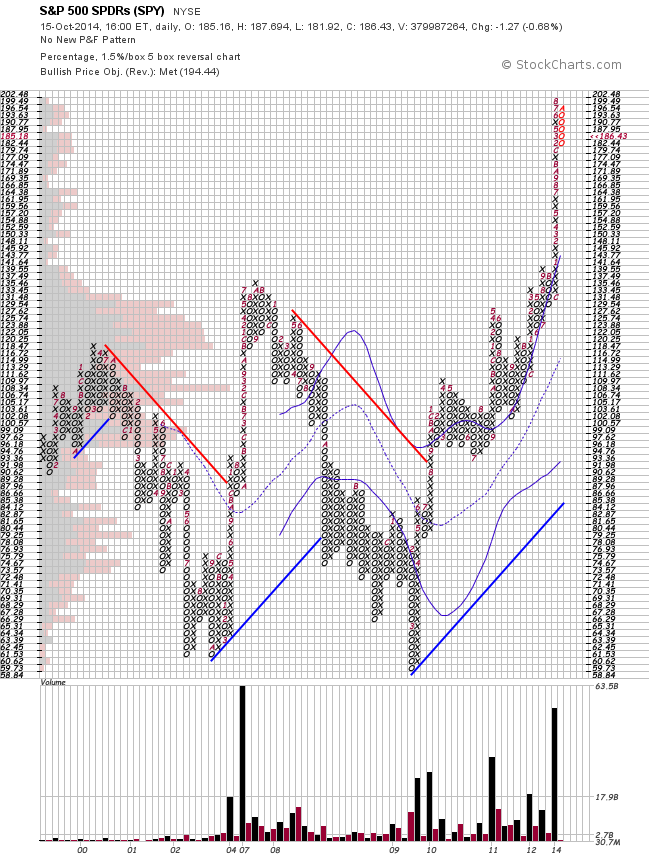

The S&P 500 currently displays structural characteristics resembling the market in August 2007, May 2010 & August 2011.

If memory serves me correct, those months were marked by an unraveling housing market, the flash crash, and a European debt crisis.

Perhaps something more substantial than Ebol-ISIS-ocalypse has infected the markets, skyrocketing treasuries and collapsing commodities often coincide with tightening credit conditions.

A 30% haircut barely takes us back to January 2013, far from the lows of 2002 & 2009, but it’s certainly enough to scare boomers contemplating retirement.

Read your tea leaves, check the entrails, converse with the spirits and note the stars, things are getting ugly out there, and nothing indicates we have found a bottom yet (except this post, the publication of which will cause the Dow to rip 1,000 points higher).