Mixed Markets with a Glimmer of Hope

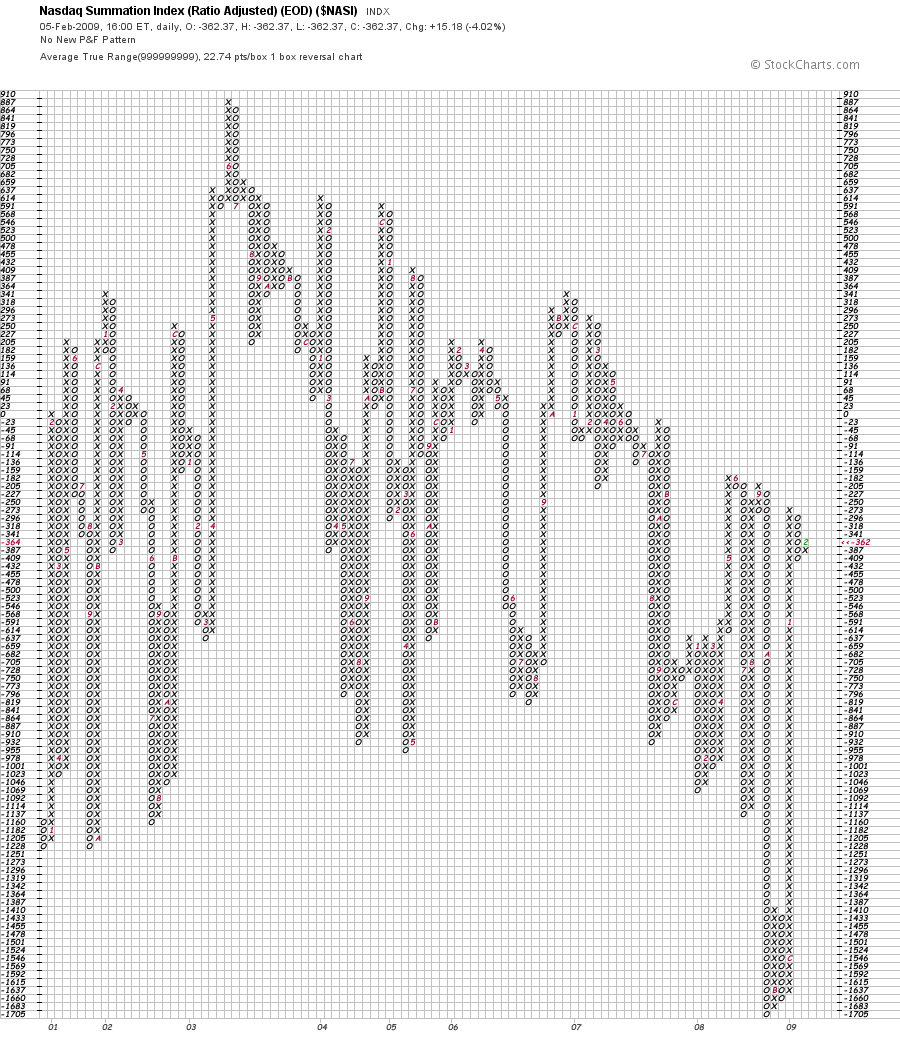

The markets remain choppy and dangerous, but the NASDAQ Summation Index is showing signs of strength. For those unfamiliar with the NASI, I suggest reading the material from stockcharts.com here. Quite simply, a rising index printing X’s is good for buyers while sellers want to see declining O’s.

As you can see on the far right, two new X’s have been formed, indicating a slight bullish bias, albeit in very bearish territory. Though no signal indicator can be counted on exclusively, this may serve as an early sign for an equity rally. Though volatility remains high, the VIX bounced off resistance, and emerging markets are enjoying a small but noticeable uptrend as the Yen/USD falls. Caution is still warranted because the majority of my indicators indicate perilous market conditions and according to the Traders Almanac, Friday the 6th is historically bearish.