Market Glance

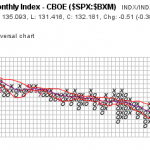

The 5 least correlated positive return ETFs show numerous markets cracking critical support and making new lows.

- 20Y Treasury Bond

- Real Estate

- Small Cap Value

- Emerging Markets

- Commodities

- % of Rising S&P 500 Stocks : S&P 500 Volatility Index

- % of S&P 500 Stocks Above 50dma : S&P 500 Volatility Index

- S&P 500 Hi-Lo : S&P 500 Volatility Index

- S&P 500 : S&P 500 Buywrite

- S&P 500 : 10Y Treasury Bond

S&P 500 indicators are bearish across the board.

The market remains fahklempt, buyers beware. The only positive things I see are emerging markets holding above the November lows, and Treasuries failing to make new highs, despite ominous news from every channel on the planet.

I’ve avoided stress by staying in cash, day trading and acquiring a girlfriend. Cash remains king, and while there are remarkable intraday opportunities, my focus is elsewhere. To paraphrase Han Solo, “what good is money if you ain’t around to spend it?”