Twitter Ticker ($AIG)

American International Group was hot on StockTwits as the insurer opened below $14 and closed at $22, a remarkable daytrade indeed. Whatever voodoo catalyzed the squeeze remains to be seen, though my sources tell me it involved monkey flatulence and Franz Geithner.

American International Group was hot on StockTwits as the insurer opened below $14 and closed at $22, a remarkable daytrade indeed. Whatever voodoo catalyzed the squeeze remains to be seen, though my sources tell me it involved monkey flatulence and Franz Geithner.

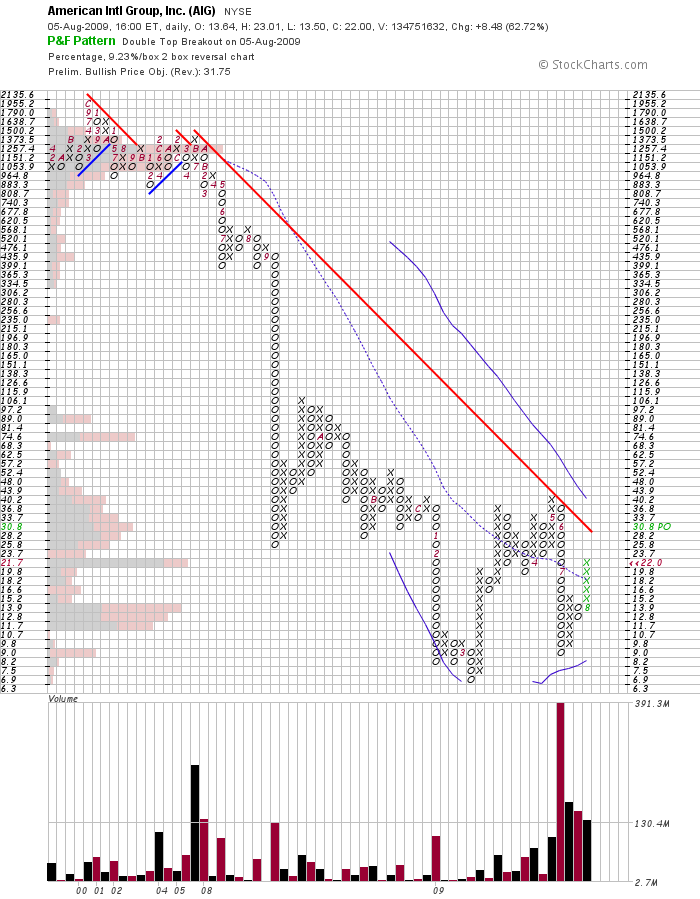

Though AIG is in a primary downtrend, the secondary trend is above the 20sma, suggesting a target of $30.8. A move below $18.20 would neutralize the secondary downtrend, but $11.70 is the last visible support on this timeframe.

Regardless, the financial sector continues to skin every last bear, even the blokes at Fannie Mae and Freddie Mac are catching a bid. Shorts are fighting the Fed, and judging by the higher lows and higher highs, the printing press is working.

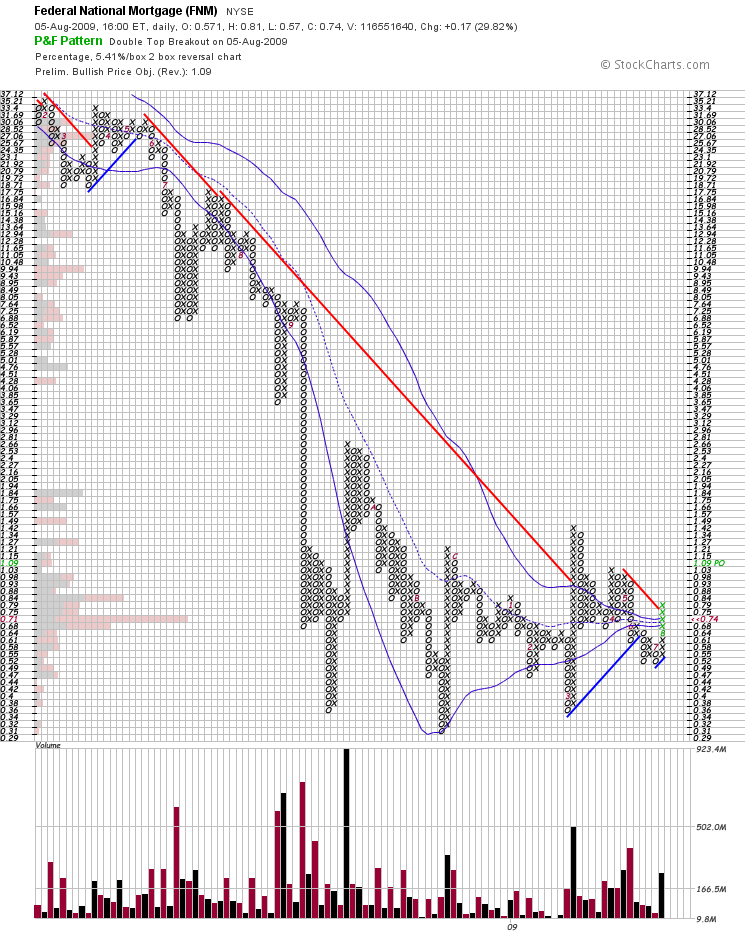

FNM had a major breakout today, and it’s in a much better technical position relative to AIG. Trading in an uptrend above a rising upper Bollinger is quite bullish in this market, and it has a price target of 1.09. A trade below .68 would endanger the uptrend, but .49 is the last known support.

FNM had a major breakout today, and it’s in a much better technical position relative to AIG. Trading in an uptrend above a rising upper Bollinger is quite bullish in this market, and it has a price target of 1.09. A trade below .68 would endanger the uptrend, but .49 is the last known support.

These government shell companies are casino stocks for savvy traders with a keen sense of position size and time horizon. There is plenty of money to be made, but bear in mind these stocks can move up 300% and crash 75% a few weeks later.